Summary

Summary

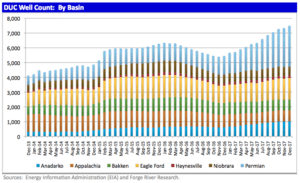

Drilled But Uncompleted (DUC) wells end 2017 at 7,493, up 37.4% versus ending 2016 and up 2.1% (156 wells) from November levels.

Crude oil prices have surged 21.3% over the past 12 months and are now well above break-even prices for almost all DUC wells.

Will higher crude oil prices cause a surge in completions and America oil production that will derail the oil price rally?

Investment thesis

We believe that the growth in drilled but uncompleted (DUC) wells provides operational flexibility and efficiency to shale oil producers and is not the overhang some investors in shale oil producers fear.

In our opinion, concerns over a sharper than expected rise in production levels from America’s shale basins in 2018 due to an accelerated takedown of DUC inventories are overdone.

We discuss many factors that will contribute to a steady work-off of the DUC well inventory versus concerns about the sensitivity or overheating of completion activity due to higher oil prices.

Drilled but uncompleted wells continue to rise

America oil drillers ended 2017 with a total of 7,493 DUC wells according to the latest report by the United States Energy Information Administration (EIA). Read more…