HEW-TEX INDUSTRY NEWS ROOM

Permian producers become “victims of their own success”

Despite a few recent snags, Permian basin production should continue its upward trend through 2019.

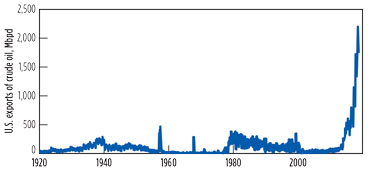

The prolific Permian basin, which stretches across much of West Texas and southeastern New Mexico, continues to lead the U.S. shale expansion. In June 2018, American crude exports soared to 2.200 MMbpd, up from 2.005 MMbpd reported the month prior, according to U.S. Energy Information Administration (EIA) data. With global oil demand on the rise, and refiners running at or near capacity, more and more crude is being sent abroad. Additionally, U.S. sanctions on Iran, to a certain degree, are creating more demand for U.S. exports, as some buyers worldwide seek to replace Iranian crude. However, the granting of waivers to eight countries by President Trump, allowing them to continue buying Iranian crude in the short term, has blunted the impact of this factor.

According to EIA’s most recent Drilling Productivity Report, the Permian basin in November was producing 3.632 MMbopd and 12.162 Bcfgd. This doesn’t include the 3,866 reported DUC wells awaiting completion in the Permian, suggesting that a flood of new production is likely to be released into the market during 2019. Average lateral lengths in horizontal wells grew more than 1,500 ft, to an average 7,500 ft at the end of 2017. This year, the range of lateral lengths has been mostly between 4,500 ft and 10,500 ft, although some wells have featured lengths up to 15,000 ft. It is believed that the average lateral length has grown to more than 8,000 ft during 2018. Read more…

Shell seen reclaiming dominance in Texas shale country

World Oil : By KELLY GILBLOM on 6/18/2018

LONDON (Bloomberg) — Shale oil hasn’t always been Royal Dutch Shell Plc’s best friend, but they’re working on the relationship.

LONDON (Bloomberg) — Shale oil hasn’t always been Royal Dutch Shell Plc’s best friend, but they’re working on the relationship.

Shell is said to have bid, with partner Blackstone Group LP, on a portfolio of U.S. shale assets BHP Billiton Ltd. wants to sell for about $10 billion. If it wins, the Anglo-Dutch oil major could exceed its goal of doubling its American onshore output, according to JPMorgan Chase & Co.

That would boost the unit’s free cash flow — currently on track to grow by $2 billion by 2025 — and turn around a shale portfolio that is currently “mid-lower ranked,” analysts from the bank including Christyan Malek said in a report.

At the heart of Shell’s shale problem has been the lack of a coherent strategy, according to the report. It has irregularly acquired various bits of U.S. acreage, including a large stake in the low-cost and highly desirable Permian.

The Permian Basin in Texas and New Mexico will soon become the third-biggest oil producing region in the world: IHS Markit

- Output from the Permian basin is poised to double between 2017 and 2023, according to IHS Markit.

- At 5.4 million barrels per day, Permian production would surpass output from all other producer nation’s except Saudi Arabia and Russia.

- IHS Markit believes the jump in output will require more than $300 billion in investment.

Today, the Permian basin in Texas and New Mexico is the nation’s biggest shale oil producing region. But in just a few years, drillers could be pumping enough Permian crude to outmatch every nation in the world except Russia and Saudi Arabia.

Devon Energy Corp Doesn’t Disappoint

What Trump’s Iran decision means for oil and gas prices

MSN.com : CNN : Matt Egan

President Donald Trump chose a dicey time to crack down on Iran, the world’s fifth-biggest oil producer.

Global oil supplies were already getting tight before Trump vowed on Tuesday to exit the Iran nuclear deal and impose “powerful” sanctions on the OPEC nation.

Energy industry insiders say Trump’s tough stance on Iran will probably keep oil and gasoline prices higher than they would otherwise be.

Iran ramped up its oil production by 1 million barrels per day after sanctions were lifted in early 2016. At least some of that oil will now be pulled from the market — at a time when oil prices are already rising because of production cuts by OPEC and Russia as well as instability in Venezuela. read more…

Why The Permian Is Set For A Shakeout

Forbes.com : Business : Wood Mackenzie , Contributor : APR 30, 2018 @ 04:38 AM

Motives for both the tight oil ‘haves’ and ‘have nots’

The best accessible upstream growth opportunity in fifty years? US tight oil. Correction: the Permian Basin. Second correction: the Wolfcamp formation spread across the Delaware and Midland sub-basins.

It’s this play that drives most of the growth in tight oil, from 5 million b/d today to the 10 million b/d we forecast in the middle of next decade. No surprise then, that those already big in the play want more of it.

But does Concho Resources’ acquisition of RSP Permian for US$9.5 billion – the biggest deal yet – signal the start of Permian consolidation?

I caught up with Ben Shattuck, Research Director, US Lower 48.

Q. Ben, is Concho doubling up on what it does best?

BNEF Brief: Permian Basin’s Impact on Global Oil Supply

Nasdaq : AOL Network – April. 26, 2018

Apr.26 — Selling more than two million barrels a day of U.S. crude overseas may soon be the new normal. The U.S. sent out record amounts of crude to foreign destinations last week, with domestic output hitting an all-time high, thanks to growth in the Permian Basin. Bert Gilbert, Bloomberg New Energy Finance oil analyst, joins Bloomberg’s Alix Steel for this week’s “BNEF Brief” on “Bloomberg Commodities Edge.” Read more…

Permian Basin Is Growing Into the Largest Oil Patch in the World

Bloomberg: Markets By Jessica Summers and Sheela Tobben

The Permian shale play is all about setting records. Now, the region will probably become the world’s largest oil patch over the next decade.

Output in the basin is forecast to reach 3.18 million barrels a day in May, according to the Energy Information Administration. That’s the highest since the agency began compiling records in 2007. The size of the oil deposits coupled with increased technology and efficiency are fueling the rampant growth.

“The technology is the biggest driver,” said Rob Thummel, managing director at Tortoise, which handles $16 billion in energy-related assets. “The basin in and of itself could end up being the largest oil field in the world.”

By contrast, top-producing members of OPEC such as Iran and Iraq pump less than 5 million barrels a day. Iran produced about 3.81 million barrels day in March, according to data compiled by Bloomberg.

“If the Permian was part of OPEC, it would be the fourth-largest OPEC member, right behind Saudi Arabia, Iran and Iraq,” Thummel said. “By the end of the year, the Permian probably overtakes Iran.” Read more…

Shaletech: Permian Basin

World Oil: Jim Redden, Contributing Editor

Soaring drilling, production block out irritants

The storied wide open spaces of West Texas aren’t so much these days.

Despite an aerial reach of more than 75,000 mi2, overlaying up to 12 prospective zones, the growing population of rigs and frac spreads in the invincible Permian basin of Texas and southeastern New Mexico has made well spacing a dicey issue. Get too close and ultimate reservoir drainage could take a literal hit, or in the vernacular of RSP Permian Inc., fall victim to “frac bashing.”

“What the data is showing us is that we’ve been able to drill wells down to about 400 ft apart, without seeing really any negative results from offset wells. But, when you get below 400 ft, you start to see that,” CEO Steven Gray says of his pure-play company’s experience while developing a 92,000-net-acre leasehold across the Midland and Delaware sub-basins.

With 435 active rigs, like this one drilling for Anadarko in the Delaware sub-basin, well spacing has become a tricky issue across the Permian basin. Image: Anadarko Petroleum Corp.

The more commonly known “frac hits” phenomenon joins rising service, labor and acreage costs, and impending takeaway concerns, in what is arguably the world’s most celebrated unconventional oil play. Headwinds aside, “the Permian continues to look more attractive than most other options for new investment in the global upstream hopper,” Wood Mackenzie Chairman and Chief Analyst Simon Flowers wrote in a Feb. 13 note. Read more…

Concho Deal Creates Permian Basin Giant

Matt Zborowski, Technology Writer | 28 March 2018

Journal of Petroleum Technology

Concho Resources has agreed to acquire RSP Permian in an all-stock deal valued at $9.5 billion including $1.5 billion in RSP debt. The move is expected to make Concho the Permian Basin’s most-active driller and its largest oil and gas producer from unconventional shale, the operators said in a joint release.

The combined company will hold some 640,000 net acres in the basin and operate a 27-rig program, with fourth-quarter 2017 production of 267,000 BOE/D. RSP is providing Concho some 92,000 net acres, split almost evenly between the Midland and Delaware Basins, along with seven active drilling rigs. Its fourth-quarter 2017 production was 56,000 BOE/D, of which 80% was oil and 20% was gas. Once the deal is complete, Concho will have 26,000 gross locations and a net resources of 12.2 billion BOE.

Tim Leach, Concho’s chairman and chief executive officer, said RSP’s assets “seamlessly fold into our drilling program” and “enhance our scale advantage” in Permian. Efficiencies are expected through large-scale, multi-well projects that provide costs savings through batch drilling and completions and maximize recoveries by reducing “parent-child” infill locations. Concho expects a present value of corporate and operational synergies from the deal of more than $2 billion, which includes asset optimization, directing capital to high-return manufacturing-style projects, and shared infrastructure. Read more…

The public portion of this site contains only general information regarding classes of products and services that are designed to meet the needs of qualified investors. This is not an offer to sell or solicitation of an offer to buy any security listed herein. Such offer may only be made by written memorandum in a jurisdiction where the offering is duly registered or exempt there from. Please see our investor protection page or download our due diligence, which outlines important information from the US securities and exchange commission (SEC) on recognizing and avoiding oil and gas investment scams. For the complete publication see www.sec.gov/investor/pubs/oilgasscams.htm. Prospective investors should be cautioned that prior performance may not be indicative of future results in any investment, and there can be no prediction as to the future production, if any, of any well to be drilled. Energy investments are speculative and involve a high degree of risk. Oil and natural gas wells are naturally depleting assets. Cash flows and returns may vary and are not guaranteed. Past performance is no indication of future performance. Nothing herein shall be construed as tax or accounting advice. Investors may lose money.