HEW-TEX INDUSTRY NEWS ROOM

Low-Cost Oil & Gas Player in High-Rent Permian Basin

Source: Streetwise Reports (11/21/17)

An oil E&P company has acquired rights at low cost in the prolific Permian Basin that it is now exploring and producing.

The price of oil has been rising in recent weeks, with West Texas Intermediate Crude now fetching $57 per barrel.

The Permian Basin, a prolific oil and gas producing area spanning West Texas and southeastern New Mexico that some people have called “America’s Saudi Arabia,” has attracted the attention of majors such as Exxon (XOM:NYSE) and Chevron (CVX:NYSE). Earlier this year, Exxon acquired acquired about 275,000 acres of leasehold in the Permian Basin from companies owned by the Bass family, with an estimated 3.4 billion barrels of oil equivalent.

Chevron has been active in the Permian Basin since the 1920s and holds about 2 million net acres of resources. The company has produced over 5 billion barrels from the area. Read more…

Exxon Mobil Expands With Permian Basin Terminal Acquisition

It seems like Exxon Mobil Corp. (NYSE: XOM) is located in just about every major oil and gas effort around the planet. After all, it is the largest American oil and gas company by far. Now Exxon is acquiring a crude oil terminal that will serve the growing Delaware Basin located within the Permian Basin. Financial terms of the deal were not disclosed.

What should matter to investors of Exxon and to investors who are targeting the Permian Basin is that Exxon said this is its first terminal in the Permian Basin to be anchored by the corporation’s newly acquired (announced in January) Delaware Basin acreage. That being said, Exxon’s market cap of $350 billion means that no single acquisition or asset sale is likely to make a meaningful difference in Exxon’s earnings individually.

Wednesday’s press release is said to establish Exxon as a key midstream provider in the rapidly growing Permian Basin and this crude oil terminal is permitted for 100,000 barrels per day of throughput. It is also said to have the ability to expand. The terminal provides transportation and storage options for Permian Basin producers and is located in Wink, Texas. Read more…

EIA: Permian basin to drive fourth-quarter U.S crude production increases

WorldOil.com

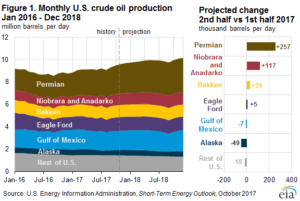

WASHINGTON, D.C. — In its Short-Term Energy Outlook (STEO) update released this week, EIA forecasts that U.S crude oil production will average 9.4 MMbpd in the second half of 2017, 340,000 bpd more than in the first half of 2017.

EIA’s close monitoring of current rig activity in several producing regions shows continued production growth from tight-oil formations, such as shale in the Permian region, driving overall production increases.

The STEO projects that the most significant production growth in the second half of 2017 will be in the Permian region. Permian production is forecast to grow to 2.6 MMbpd in the second half of 2017, a 260,000 bpd increase from the first half of 2017. Production in the Permian continues to increase, in part as a result of West Texas Intermediate (WTI) crude oil average monthly prices that have remained higher than $45/bbl since the second half of 2016.

Extending across western Texas and southeastern New Mexico, the Permian region has developed into one of the more active drilling regions in the United States because its large geographic size and favorable geology contain many prolific tight formations such as the Wolfcamp, Spraberry, and Bonespring. Increases in proppant intensity, lateral lengths, and changes to slick-water completions are also among the factors that have allowed the Permian to remain one of the most economic regions for oil production despite the low-oil-price environment. WTI spot prices averaged $50/bbl in the first half of 2017, spurring deployment of more rigs to the Permian, which rose steadily from 276 rigs in January to 380 rigs in September. The STEO projects that the Permian region rig count will continue to grow from an average of 341 rigs in 2017 to 371 rigs in 2018, and the WTI price is forecast to average $49/bbl for the second half of 2017 and $51/bbl in 2018. Read more…

Extending across western Texas and southeastern New Mexico, the Permian region has developed into one of the more active drilling regions in the United States because its large geographic size and favorable geology contain many prolific tight formations such as the Wolfcamp, Spraberry, and Bonespring. Increases in proppant intensity, lateral lengths, and changes to slick-water completions are also among the factors that have allowed the Permian to remain one of the most economic regions for oil production despite the low-oil-price environment. WTI spot prices averaged $50/bbl in the first half of 2017, spurring deployment of more rigs to the Permian, which rose steadily from 276 rigs in January to 380 rigs in September. The STEO projects that the Permian region rig count will continue to grow from an average of 341 rigs in 2017 to 371 rigs in 2018, and the WTI price is forecast to average $49/bbl for the second half of 2017 and $51/bbl in 2018. Read more…

Dirty water in U.S. shale patch drives investment in water handlers

HOUSTON (Reuters) – Huge volumes of dirty water produced by U.S. shale firms are driving up investment in water-handling specialists, as cash-conscious oil and gas companies try to trim costs.

For every barrel of crude, drillers generate up to six barrels of brackish water containing chemicals used to release oil and gas from shale rock. The water is trucked or piped to disposal wells, or recycled.

Transporting and disposing of water is costly for energy producers who are cash-strapped after more than two years of slumping oil prices, and some are opting to sell pipelines and wells to wastewater companies and then pay them to manage water. Read more…

‘Game-Changing’ New Research on Prolific Permian Basin Estimates 60 Billion to 70 Billion Barrels Remain, IHS Markit Says

The Permian Basin is Headed for a Second Peak. Source: IHS Markit 2017

The Permian Basin is Headed for a Second Peak. Source: IHS Markit 2017

www.businesswire.com

HOUSTON–(BUSINESS WIRE)–Energy researchers at IHS Markit have completed the first, three-year phase of a massive Permian Basin research project that models and interprets the giant basin’s key geologic characteristics to better estimate its remaining hydrocarbon potential, and initial results indicate the giant basin still holds an estimated 60 billion to 70 billion barrels of technically recoverable resources. Read more…

Permian ‘Super Basin’ Holds Up to $3.3 Trillion in Untapped Oil

By: Joe Carroll

The Permian Basin of Texas and New Mexico holds 60 billion to 70 billion barrels of yet-to-be pumped crude oil, according to a study by IHS Markit Ltd.

Regional Report: Permian Basin

September 2017

Worldoil.com : The ultimate U.S. basin shines again

Mike Slaton, Contributing Editor

Permian production continues to increase, and it may reach 2.9 MMbopd by the end of 2018. That would be about 30% of total U.S. crude oil production next year. The rotary rig count, about 40% of the U.S. total, is 207 units ahead of last year. Railroad Commission drilling permits at mid-year are within 626 of the total issued in 2016.

There’s a lot driving this growth. Technological leadership in developing unconventional resources; an extensive and growing infrastructure; a skilled workforce; and a long stretch of painful cost-cutting have driven down expenses, and improved well economics to put some assets within reach of $40 oil. Production for the last half of the year is being hedged at a relatively low $50/bbl. And, lo and behold, WTI crude prices that were above $50 at the start of the year and flirted with $43 in June had rallied back to near $50 at the end of July.

The pace of mergers, acquisitions, and divestitures adds to the churn, with an influx of money, ownership and ambition. Properties continue to change hands at a blistering rate, building momentum from 2016’s $28 billion in land acquisitions. The year started with ExxonMobil’s $6.6-billion expansion and Noble Energy’s $2.7-billion agreement, followed quickly by Parsley Energy’s $2.8-billion addition and a slew of other deals.

All of this investment rests on massive, stacked pay resources sprawled across 86,000 mi2, two states and 52 counties. Today’s 2-mi laterals and multi-stage completions have come a long way, and through a lot of ups and downs from 1923, when Texon Oil and Land Co. brought in the Santa Rita No. 1. But, perhaps modern Permian basin wells haven’t ventured far in spirit from the original discovery near Big Lake. Spudded on the day that the permit was due to expire, the well struck oil after 21 months of cable tool drilling, and it produced for nearly seven decades.

RIGS, PERMITS, AND PRODUCTION NUMBERS

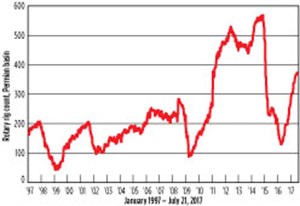

During the week of July 28, Baker Hughes counted 931 U.S. rigs, up from 440 last year. Texas had 462 rigs making hole (214 in 2016), and the Permian basin accounted for 379 of them—about 80% of Texas rigs and 40% of U.S. rigs. That’s up from a bleak 172 rotary rigs last year. (For perspective, the Permian basin rig count reached 568 in late 2014 before falling to a low of 134 in spring 2016, Fig 1.) Read more…

Forget Oil, Water Is New Ticket for Pipeline Growth in Texas

By David Wethe and Ryan Collins

The torrent of dirty water coming out of almost every American oil well is the next big bet for a former fund manager for billionaire Paul Allen.

Getting rid of wastewater from onshore wells has become an increasingly costly problem for oil producers as U.S. crude output surged in recent years, especially in the new shale fields from Texas to North Dakota. Drillers typically get about seven barrels of water for every one of oil, and some struggle to deal with the overflow that is mostly sent by truck to disposal sites miles away. Read more…

Exxon doubles profit, expanding operations in Permian Basin

Exxon Mobil Corp.’s profits doubled in the second quarter on increased energy prices and refining margins compared to last year, the company said Friday.

The Irving, oil company collected $3.4 billion in net income, or 78 cents a share, from the beginning of April to the end of June, compared to $1.7 billion, or 41 cents a share, in the same period last year. Its revenue climbed from $57.7 billion to $72.9 billion.

The oil giant plans to add another three drilling rigs in the Permian Basin in West Texas, bringing its active fleet there to 19 rigs by the end of August. It has boosted production in the region 20 percent to more than 165,000 barrels a day across its 1.8 million acres.

“The Permian ranks among the top tier investment returns in our global portfolio,” said Jeff Woodbury, a spokesman for Exxon Mobil, in a conference call with investors. “We have successfully offset inflationary pressures through efficiencies” and higher output for each well the company drills. Read more…

Explaining The Permian Scramble

GUEST POST WRITTEN BY : James L. Rice III and Katy Lukaszewski

The authors are attorneys at Sidley Austin LLP

Oil production is surging in the Permian basin of west Texas and southeastern New Mexico. Output has doubled in the past five years to 2.4 million barrels per day, a quarter of U.S. supply. Drillers are piling it. Over the past year the M&A deals have been coming so fast in the Permian basin of Texas that if you blink you’ll miss one.

Company after company has piled in, paying more than $20,000 an acre for drilling rights. And that’s just the ante. As oil companies delineate more and layers of oil-soaked rock beneath the Permian, their inventory of drilling locations has exploded. In time, each square mile out there could see 30 wells drilled into it, at a cost of hundreds of millions of dollars.

Operators say big parts of the Permian are economic to drill even at $40 a barrel. Which is why we’re seeing more and more companies shedding producing assets in other geographic areas via wholesale basin exits to generate proceeds that they are plowing into largely undeveloped Permian positions. Read more…

The public portion of this site contains only general information regarding classes of products and services that are designed to meet the needs of qualified investors. This is not an offer to sell or solicitation of an offer to buy any security listed herein. Such offer may only be made by written memorandum in a jurisdiction where the offering is duly registered or exempt there from. Please see our investor protection page or download our due diligence, which outlines important information from the US securities and exchange commission (SEC) on recognizing and avoiding oil and gas investment scams. For the complete publication see www.sec.gov/investor/pubs/oilgasscams.htm. Prospective investors should be cautioned that prior performance may not be indicative of future results in any investment, and there can be no prediction as to the future production, if any, of any well to be drilled. Energy investments are speculative and involve a high degree of risk. Oil and natural gas wells are naturally depleting assets. Cash flows and returns may vary and are not guaranteed. Past performance is no indication of future performance. Nothing herein shall be construed as tax or accounting advice. Investors may lose money.