HEW-TEX INDUSTRY NEWS ROOM

$9.5 Billion Shale Deal Could Signal Consolidation in Permian

Concho Resources’ purchase of RSP Permian would create biggest active driller in shale hotspot

Concho Resources Inc. has agreed to buy RSP Permian Inc.in a deal that could herald the start of a consolidation push in America’s most active shale-drilling region.

The companies are valuing the all-stock deal at roughly $9.5 billion, including net debt from RSP, both firms said Wednesday. That would make it the largest-ever deal in the Permian Basin, the area of Texas and New Mexico where big companies including Exxon Mobil Corp. and Chevron Corp. are now ramping up production along with smaller independent shale drillers. Read More…

Was This Oil Giant Smart or Just Lucky?

March 7, 2018, 3:01 AM MST

Chevron’s long-ignored acreage in the Permian Basin has made it a shale leader.

Bloomberg Businessweek: By Kevin Crowley and Javier BlasIn the control room of Chevron Corp.’s Scharbauer SE71 oil well, midway up a 150-foot rig in the heart of the Permian Basin, Operations Manager Scott Nash gives instructions to a contractor guiding a robotic arm screwing lengths of steel drilling pipe together. The procedure may save less than a minute per connection compared with the traditional way Chevron used to join pipe. And as recently as five years ago, the company wouldn’t have considered such a high-tech solution, especially in this arid West Texas landscape, long considered a poor candidate for profitable exploration. But today the Permian is so important to Chevron’s fortunes that saving 10 seconds each time drill pipes are linked can translate into millions of dollars in cost savings across Chevron’s huge operations there.

For Chevron, which spent the 1990s and early 2000s breaking deep-sea drilling records in the Gulf of Mexico and elsewhere, the shift to the Permian means going toe-to-toe with the fast-moving independent wildcatters, such as Mark Papa and Harold Hamm, who dominated the first chapter of the U.S. shale revolution. Chevron is determined not to let its late start hold it back. “We’re neck and neck with the little companies, and we’re still in the learning phase,” Nash says. “The 800-pound gorilla is in the room.” Read more…

Pioneer’s Decision Cements The Permian Basin’s Status As “Saudi Texas”

The report in the Dallas Morning News Wednesday morning that Pioneer Natural Resources has decided to divest all other assets in order to focus exclusively on the Permian Basin confirms what many have already known: the Permian truly is America’s “Super Basin,” or as others prefer to call it, Saudi Texas.

After all, it isn’t as if the assets Pioneer will divest are just your basic oilfield garbage: They include roughly 70,000 acres of prime acreage in the Eagle Ford Shale region, in which Pioneer was an early and very successful player. They also include some prolific natural gas acreage in deep South Texas and in the Raton Basin along the border between Colorado and New Mexico.

Pioneer is a company that has had a strong record of success wherever it has produced; thus, it’s decision to focus exclusively on the Permian is strong testimony to both the magnitude of the resource available in that region, and the prime economics offered by prolific oil and natural gas formations stacked one atop another throughout a vast region that is larger than the state of South Carolina. Read more…

Permian Seen Second to Saudis for Spare Oil-Output Capacity

>Bloomberg.com By Wael Mahdi –

The U.S.’s Permian Basin is looking like Saudi Arabia, with as much as 1 million barrels of spare oil capacity ready to go into production, according to Nansen Saleri, former head of reservoir management at Saudi Aramco, the world’s largest crude exporter.

Oil producers in the Permian Basin have at least a combined 500,000 barrels a day of idle oil production capacity, according to Saleri, who is now chief executive officer of Houston-based consultant Quantum Reservoir Impact. Saudi Arabia’s spare capacity is about 1.5 million barrels a day, according to data compiled by Bloomberg.

The Permian Basin of Texas and New Mexico is the engine for U.S. shale production and acquisitions, helping to increase U.S. output to more than 10 million barrels a day in November for the first time in more than four decades. Exxon Mobil Corp. is spending billions to triple output by 2025 from the Permian, where its costs are as low as $15 a barrel. Read More…

Exxon Mobil will triple production in the Permian basin, the hottest US shale oil field, by 2025

- Exxon Mobil aims to triple its production of oil and chemical feedstocks in the Permian Basin to 600,000 barrels of oil equivalent by 2025.

- The Permian has been the epicenter of the rebound in U.S. drilling in recent years following a protracted price slump.

- Exxon will also build out infrastructure to bring its crude oil and products to market.

Exxon Mobil on Tuesday said it will triple its production of oil and chemical feedstocks in one of the most productive shale basins in the United States and expand infrastructure to bring those products to market by 2025.

The announcement came one day after the world’s largest publicly listed oil company said it would ratchet up its U.S. investments to $50 billion over the next five years, in part due to the benefit of recent U.S. tax cuts.

The Irving, Texas-based oil major said it plans to increase total daily production in the U.S. Southwest’s Permian Basin by 600,000 barrels of oil equivalent, a measure of crude, natural gas and other product output. In 2016, Exxon’s total output was 4.1 million barrels of oil equivalent per day.

Exxon expects crude oil production alone to increase five-fold in the Permian, which runs beneath western Texas and eastern New Mexico. Last year, Exxon doubled its Permian holdings through the $5.6 billion acquisition of companies owned by the Bass family. Read more…

Get Ready For More Oil & Gas Deal Action In The Permian

Ask anyone in the oil and gas industry about what’s hot these days and chances are good they’ll tell you the Permian Basin in West Texas and New Mexico. It’s with good reason: There’s a lot of recoverable oil there – 60 billion to 70 billion barrels by IHS Markit’s reckoning, double what’s already been produced. And it can be brought to the surface pretty cheaply, giving its producers a high rate-of-return, even at lower oil prices.

For some companies, that might mean considering taking some money off the table, which could spur more dealmaking in the basin this year.

Analysts at Seaport Global Securities recently returned from meetings with private companies in Midland and learned that several deals are about to be hatched in the Delaware portion of the basin. One executive even speculated that there might be four to five deals announced in the next six weeks.

The analysts think that Royal Dutch Shell and Concho Resources have multiple packages for sale in Ward County, Texas, and that their positions – about 20,000 acres in total – will be “snatched up” by a mix of private and public companies. They join onetime bankrupt Vanguard Natural Resources, which announced earlier this month that it’s selling 1,700 net acres in the county. Read more…

A Look Inside The World’s Hottest Shale Play

Boomtown

Last week, my day job took me to the Permian Basin. A colleague and I arrived late at night at our hotel in Fort Stockton, Texas. The hotel parking lot was full. The vehicles in the parking lot represented every type of oilfield-related business imaginable.

At the front desk, I was told that the hotel had overbooked us. So, we had to search for new accommodations at 11 p.m., but every hotel parking lot in town was full.

After an hour of searching, we finally located a pair of the last rooms in town. The carpet in my room smelled like crude oil, but I was happy to have a bed for the night.

That’s the way it goes in the Permian these days. In fact, I heard someone say that if you can’t make money in the Permian right now, you aren’t trying.

A Century of Production

After the oil price crash that began in mid-2014, crude oil production growth in the U.S. stalled. In 2016, annual production in the Bakken and Eagle Ford formations fell by 10-20 percent, but production in the Permian Basin continued to grow.

Amazingly, the Permian is approaching a century of oil production. At present, production has reached a record 2.8 million barrels per day (BPD), making it the world’s second-most-prolific field, behind the legendary Ghawar in Saudi Arabia. Read more…

110,000 new wells coming to the Permian Basin

MIDLAND — It’s a billion dollar business and it also happens to be the epicenter of the Permian Basin – the oil and gas industry.

Take, for example, the three largest oil and gas employers in West Texas, Pioneer Natural Resources, Oxy and Diamondback Energy.

When the net worth of all three are combined, it makes up a total of $115 billion. These three companies alone are worth half as much as global retail giant Walmart.

Oil giants came together to discuss the state of oil and gas on Tuesday in Midland and they all agree that the boom and bust cycle days in the Permian Basin are over. The new mindset is all about continuous growth. In fact, over the next several years, 110,000 wells will be drilled in the Permian Basin.

“We have to make the Permian Basin a place where we can bring these people, they can bring their families – they can be educated,”

Pioneer Natural Resources President and CEO Tim Dove said.

The discussion included oil giants pointing to needs in the community based on rapid development in the industry.

“Education, affordable housing, the medical care that’s required, even recreational needs. I personally feel there’s no reason why the Midland school system shouldn’t be one of the top in the state of Texas,” Dove said. Read more…

Will Higher Oil Prices Cause Surge In Completions Of Drilled But Uncompleted Wells?

Summary

Summary

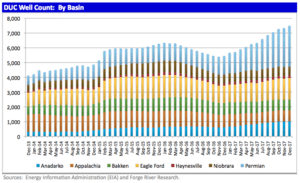

Drilled But Uncompleted (DUC) wells end 2017 at 7,493, up 37.4% versus ending 2016 and up 2.1% (156 wells) from November levels.

Crude oil prices have surged 21.3% over the past 12 months and are now well above break-even prices for almost all DUC wells.

Will higher crude oil prices cause a surge in completions and America oil production that will derail the oil price rally?

Investment thesis

We believe that the growth in drilled but uncompleted (DUC) wells provides operational flexibility and efficiency to shale oil producers and is not the overhang some investors in shale oil producers fear.

In our opinion, concerns over a sharper than expected rise in production levels from America’s shale basins in 2018 due to an accelerated takedown of DUC inventories are overdone.

We discuss many factors that will contribute to a steady work-off of the DUC well inventory versus concerns about the sensitivity or overheating of completion activity due to higher oil prices.

Drilled but uncompleted wells continue to rise

America oil drillers ended 2017 with a total of 7,493 DUC wells according to the latest report by the United States Energy Information Administration (EIA). Read more…

The public portion of this site contains only general information regarding classes of products and services that are designed to meet the needs of qualified investors. This is not an offer to sell or solicitation of an offer to buy any security listed herein. Such offer may only be made by written memorandum in a jurisdiction where the offering is duly registered or exempt there from. Please see our investor protection page or download our due diligence, which outlines important information from the US securities and exchange commission (SEC) on recognizing and avoiding oil and gas investment scams. For the complete publication see www.sec.gov/investor/pubs/oilgasscams.htm. Prospective investors should be cautioned that prior performance may not be indicative of future results in any investment, and there can be no prediction as to the future production, if any, of any well to be drilled. Energy investments are speculative and involve a high degree of risk. Oil and natural gas wells are naturally depleting assets. Cash flows and returns may vary and are not guaranteed. Past performance is no indication of future performance. Nothing herein shall be construed as tax or accounting advice. Investors may lose money.