Summary

Summary

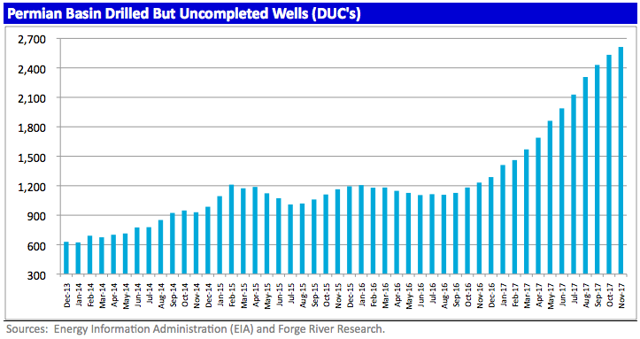

The number of Drilled But Uncompleted (DUC) wells in the Permian has surged over 112% the past 12 months, up 15 consecutive months.

Permian DUC wells now total a record 2,613 wells at the end of October (35.0% of the 7,354 total DUC’s).

DUC wells in all other American basins declined by 68 to 7,354, the first monthly decline in since November 2016.

Completion crews, water handling, and other infrastructure constraints mean that the Permian’s DUC well inventory is likely to continue to grow and take time to work off.

In our opinion, growth of DUC wells positive impacts outweigh overhang concerns.

Investment Thesis

We believe the continued growth in Permian basin Drilled but Uncompleted (DUC) wells is a not a negative overhang for oil producers or for crude oil prices.

The benefits of the growing DUC inventory include: current stability of crude oil pricing, a more measured growth in oil production supply to market, efficiencies gained in the management of fracking crews, management of near-term infrastructure constraints, management of service cost inflation, and the ability of oil producers to manage oil production guidance through completion.

While some investors worry about a sudden surge in supply should oil prices increase significantly due to rapid completion efforts, therefore, an overhang; we believe that the benefits outweigh concerns. Oil prices have recovered nicely this year despite the rise in DUC wells. While DUC well growth and completions deserve careful attention, we believe the current level of DUC wells is no providing an overhang to price stability. Read more…